As originally published on www.woodmac.com

As originally published on www.woodmac.com

In an extraordinary year, the US solar industry soldiered through pandemic setbacks to set new records across utility and residential markets in 2020. With tax incentives for renewable energy projects helping to maintain that momentum in 2021 and beyond, the main question now becomes: what could hold the industry back?

A full analysis of each market segment including our 10-year outlooks can be found in our US Solar Market Insight 2020 Year in Review, created in collaboration with the Solar Energy Industries Association (SEIA). Fill in the form for a complimentary copy of the 20 page executive summary. Or read on for some highlights of US solar’s strong performance in 2020.

A record 19.2 gigawatts of solar capacity was installed in 2020

The US solar industry saw staggering 43% year-on-year growth in 2020, in its biggest ever year for annual installations. Quarterly records were also broken, with the eight gigawatts, direct current (GWdc) of capacity installed in Q4 2020 representing a 32% year-on-year increase.

This is especially impressive given early predictions that the pandemic (and the corresponding economic impacts) would suppress solar’s growth potential. Utility-scale solar projects did face some delays, but construction and development activity continued to progress throughout the year. Meanwhile, slowdowns in second quarter sales of distributed solar proved temporary, and many residential installers report their sales pipelines are now larger than ever.

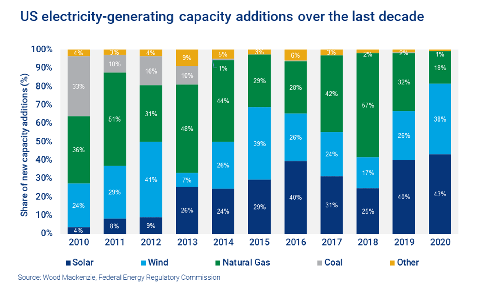

Solar added more generating capacity in the US than any other technology

Solar made up 43% of the electricity generating capacity added in the US during 2020. Not only was this the largest share in the industry’s history, it was also the second consecutive year that solar ranked first among all generation technologies. Notably, solar and wind made up 81% of new capacity in 2020 — substantially more than the previous record of 68% in 2015.

Utility solar was up 65% year-on-year

Carbon reduction commitments from utilities, governments, and corporations drove robust utility-scale solar procurement, driving the US solar industry’s growth in 2020. Not only did the segment break quarterly capacity records and hit an annual capacity record of nearly 14 GWdc, but the pipeline of contracted projects continued to grow. The 30.6 GWdc of new projects signed in 2020 exceeded the total volume of all contracted projects prior to 2019.

Utility solar is expected to continue its stellar growth over the next decade, driven by more carbon reduction targets, increasing cost competitiveness, and the viability of utility scale solar paired with storage to replace retiring fossil plants.

Surging consumer interest saw 400,000 homeowners install residential solar

Pent-up demand from pandemic-related disruption during the second quarter of 2020 combined with a surge in interest for home improvements to generate record-breaking sales pipelines for residential solar in the second half of the year. Installations in the final quarter were up 28% from Q3 for a total of 963 megawatts (MW). These record-setting sales pipelines will carry over into the first quarter of 2021.

Another driver of high growth in the first half of 2021 is expected to be the surge in demand caused by the Texas winter storms in mid-February. Online solar sales platforms saw a 200-300% surge in website traffic from Texas-based customers, mimicking heightened customer interest in the wake of mandated power shutoffs due to California wildfires in October 2019. Such events will continue to drive interest in residential solar and solar-plus-storage, with knock-on effects in other markets.

What next for US solar?

The two-year extension of the federal investment tax credit (ITC) for renewable energy at current levels (26%) promises to continue the momentum for US solar, and consequently, it has increased our outlooks for the next several years. Meanwhile, in the longer term we expect increasing carbon reduction targets and falling costs will secure solar’s dominance in power.

So, as the solar industry charges ahead, what could hold it back? One issue we have already covered involves constraints on tax equity financing, especially now that the ITC has been extended. Additionally, construction labourers and firms are in high demand, with developers reporting that labor shortages are one of the biggest bottlenecks to growth. And the high demand has begun to impact the supply chain, with delays in equipment delivery. Finding solutions to these constraints will be the major focus for the solar industry in the coming years.

As originally published on www.woodmac.com

About RER Energy Group

RER Energy Group is an industry leader in providing cost-effective, high-quality solar systems throughout the United States and Latin America. The company has developed more than 55 megawatts of solar energy, obtaining over $30 million in grant proceeds for commercial, industrial, agricultural, municipal, and non-profit customers. For more information, visit www.rerenergygroup.com.